#4 The Queendom approaches 💃

Founders turned funders, fundraising bootcamp, Lisbon meetup and much more.

Amela's weekly newsletter is a place to learn about startups, stay up to date with tech news in Europe and the world, and discover incredible opportunities. If you like it, subscribe and share it:

Hello everyone👋,

It’s a wonderful new week to conquer the tech world, most funds are back to net/working and founders are out there balancing the many things it takes to build venture scalable businesses. Today I want to share a beautiful song, I got the chance to listen to live this weekend:

This song definitely spoke to me, and when looking at the description Aurora had for it I could figure out why: Queendom is about celebrating all the differences in us. It’s about celebrating the women and the children and animals and the men also. We hope to create an ecosystem around us where we get to celebrate each other more 🎊

As the last bits of the European summer are approach, we see an emergence of meetups around conferences (TechBBQ, WVC, Sifted, Bits & Pretzels) and big cities. In our case we are going to Lisbon this Friday 15th, and we’ll be back in Berlin on the 26th. Come celebrate with us.

This week we reflect on a few things: the state of European fintech, the UK rejoining tech related matters, VCs who have actually walked the path previously, life balance for partners of founders and who the h* owns growth.

Without further due, let’s start! ✨

News

All about technology in Europe and the world 🌐

Europe’s founders turned VC partners 🧠

Successful founders in Europe are transitioning to venture capital roles after building their own companies. Some establish their own funds, while others join existing VC firms to leverage their industry expertise. This shift highlights the demand for their knowledge and experience in the startup ecosystem. Read more to find who is a founder turned VC.

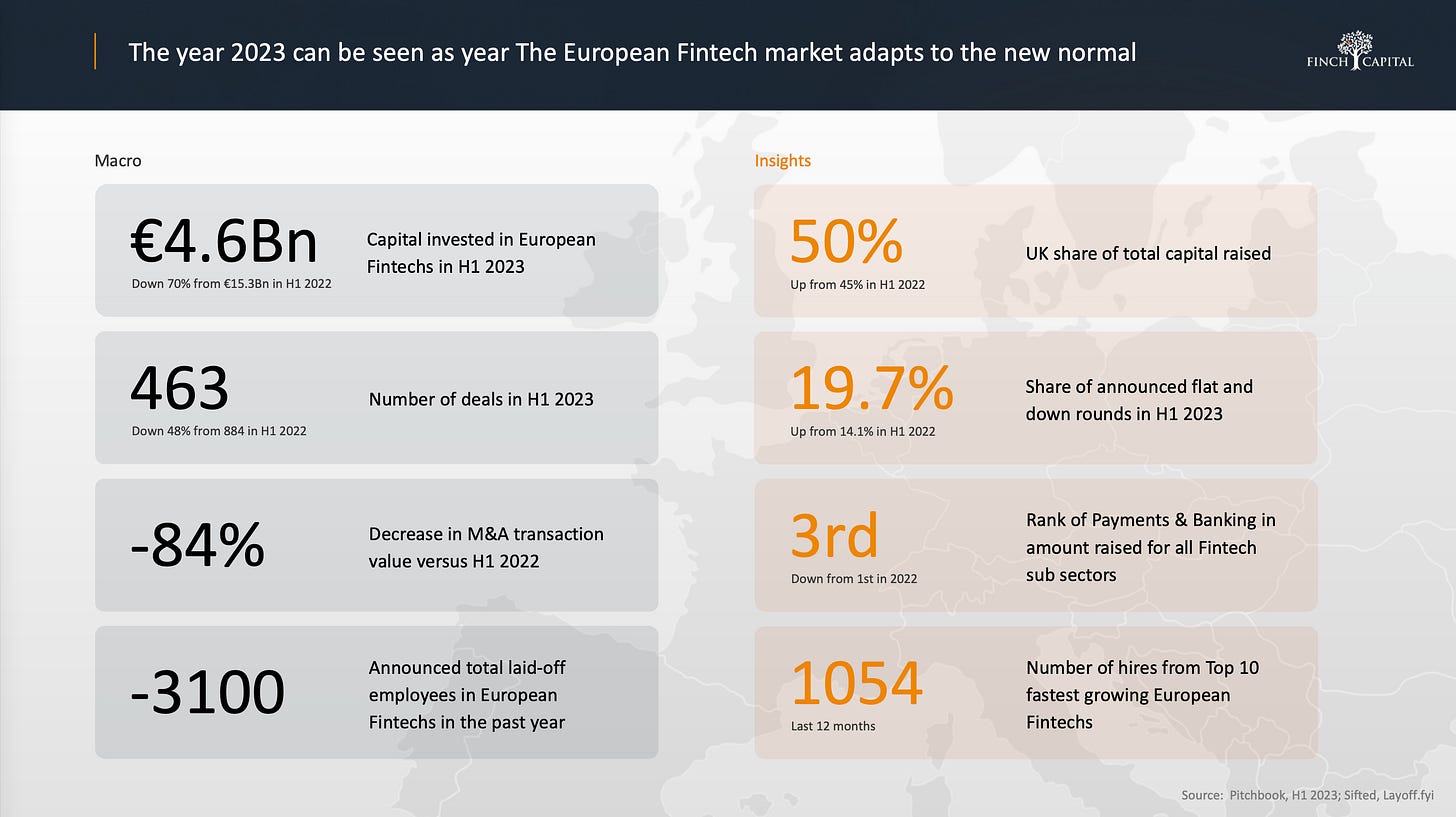

State of European FinTech💰

The 2023 State of European Fintech report highlights a return to funding discipline in the industry, with the UK showing resilience as it accounted for over 50% of European funding. However, the European fintech sector saw a significant drop in capital raised in the first half of 2023, down 70% from the previous year. Payments and crypto sectors stand out, with the latter benefiting from investor interest. Valuations in public and private technology markets are stabilizing after a retreat from previous highs, but later-stage valuations have fallen sharply. Read more here.

UK rejoins Europe’s Horizon R&D program👩🏻🔬

The United Kingdom is set to rejoin the European Union's Horizon Europe R&D funding program after a Brexit-related hiatus. The program, with a budget of €96 billion, aims to support innovation, economic growth, and high-risk R&D projects. This move is seen as a positive development for the UK's startup ecosystem and the broader tech industry, providing funding for breakthrough innovations and boosting investor confidence. The agreement in principle is expected to be finalized before the UK's formal reentry in early 2024. Read more here.

Opportunities

Open calls and events for entrepreneurs

✏️🇪🇺 Program: Focal DemoDay

A common demo day with >175 other VCs. If you’re raising Pre-seed, Seed, or Series A now, or in the next 6 months, apply now! The application window will shut end of day 18th September, ahead of demo day on 12th October. More info here.

✏️🇩🇪 Program: FoundersCircle by Techstars Berlin

Techstars Berlin introduces #FoundersCircle, a networking opportunity aiming to connect ambitious early-stage startup founders with top investors, founders, and policymakers in the German tech ecosystem through handpicked panels, office hours, and relaxed networking events, starting on September 19th. Limited spots available for Pre-Seed, Seed, and Series A founders. Apply here.

✏️🇩🇪 Event: Founder Essentials & Legals

Learn how to save on hefty notary costs that could drain your startup capital. Join Hogan Lovells' "Founder Essentials" online event on Sept. 13th, delving into innovative funding avenues like Convertible Loans and SAFEs, and offering cost insights and legal guidance for aspiring founders. Sign up here.

✏️🇵🇹 Event: Morning Club in Lisbon

Amela is expanding its Women Founder Ecosystem to Lisbon, introducing the Morning Club event for female founders and investors to connect meaningfully in a curated, pitch-free environment. This picnic-style event, limited to 15 participants, aims to foster connections. Apply here.

✏️🇬🇧 Event: Radia Accelerator Drinks

On September 19th, the Radia Accelerator is celebrating the conclusion of its first cohort at the Curve Club, where AlbionVC, Speedinvest, AWS, and HSBC Innovation Banking UK are bringing together Radia's cohort, mentors, investors, and angels. Apply to join.

✏️🇫🇷 Event: After securing funding: How to mentally prepare for the journey?

Mounia Erkha, entrepreneur coach and ex-VC, will lead a workshop specially designed for founders on September 21st. Organized by Newfund and its BrainTech fund HEKA in collaboration with Sista. Register here.

✏️🇬🇧 ĀVA Angel Investor Panel + Meet-up

Join an evening of learning, celebration, and networking after the full-day ĀVA Angel Investment Course on October 19th. Hosted by ARĀYA Ventures & HSBC Innovation Banking, engage in a panel discussion with leading UK angel investors, sharing insights, experiences, and strategies in investing. Sign up here.

😉 If you want to whisper us an event for founders, please do it here.

Fundraising Bootcamp

We just launched our Fundraising Bootcamp, aimed to support founders of diverse teams (at least with one woman founder) with putting the pedal into their upcoming fundraise. More information here.

If you are not part of Amela, join a 240+ tech women founder community across 9 countries 👉 https://bit.ly/amelajoin

Recommendations

Articles, videos and other resources to learn

Do Startup Valuations Matter for Investment Returns? 🤔

The article explores the impact of startup valuations on investment returns, using AngelList data. It finds that despite a wide range of valuations in seed deals, there's no evidence that higher or lower-priced deals result in better returns for investors. The data also shows that valuations have increased over time, and a startup's markup rate is not strongly correlated with its valuation, suggesting that valuations may matter less than the decision to invest. Read more here.

Founder Partner study 🫀

The Founder Study Group, consisting of nearly 200 funded but not yet exited founders, conducted a survey, this time involving the spouses of these founders to understand their experiences. The findings reveal that 74% of founder's spouses consider the startup as the most dominant factor in their lives. Spouses with independent careers tend to report higher satisfaction, but 32% mentioned that their careers were negatively impacted by the startup, while 24% reported a positive impact. Read more here.

Who owns “growth”? It’s complicated 🤷🏽♀️

The article explores the ownership of "growth" in software companies. A great reflection of the different roles that sales, customer success, marketing, growth and product management have and their inter-dynamics. Additionally, it highlights the importance of using the right tools, such as product analytics, onboarding, experimentation, lifecycle marketing, interactive demos, and product-led sales, to efficiently achieve growth KPIs. These tools vary in adoption across different types of companies, with PLG-native firms often leading the way in experimentation and product-led sales. Read more here.

Building in Emerging Markets 🏗️

We had the chance to participate in an amazing discussion about building in emerging markets and made some parallels between that and also building in Europe. If you are curious, give it a listen here.

See you next week! - 👋🏽 Anais